How to Build a Safe and Secure Digital Wallet

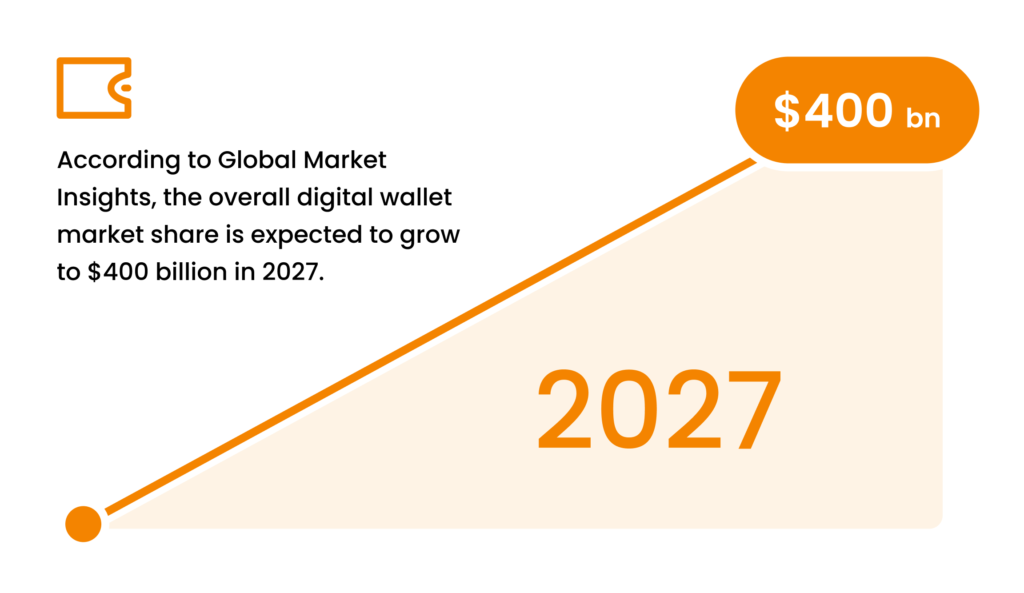

In this article, we’re going to explore the digital wallets – a commodity fintech solution that is no longer nice-to-have but must-have to complete today and is expected to become one of the dominant technologies by 2029.

As a part of our discussion, we’ll find out what benefits this technology poses for the financial industry and ordinary consumers, and, finally, share some great tips on how to launch a secure digital wallet and make the most of this product development.

FinTech Industry Trend for the Upcoming 2022: Digital Wallets

With over 500 innovative tech solutions launched each year in the financial industry, it’s essential to uncover the trending yet prospective technologies on the market and inspect the overall vector of the industry development.

So, along with the commonly known AI and ML technologies, as well as big data analytics, the evolving fintech trend we should make a major focus on today is digital wallet solutions.

The increasing smartphone adoption, availability of different digital wallet apps, as well as the rise of various consumer pains and needs, have been stimulating the demand for digital payment solutions entering the industry.

Apart from smartphone availability, the other major drivers for this technology growth include the rise of various e-commerce platforms, supportive governmental initiatives, attractive discounts and cashback offers from digital wallet providers, and many more.

Benefits of Launching a Digital Wallet App

In fact, digital wallet development has plenty of benefits for the service providers and their consumers. From the last one’s point of view, this technology enables simplifying the payment-making process and completing the transactions cash-free, while protecting financial account information and all the passwords.

Additionally, the advanced encryption and virtualization approach ensure that personal information will never leave the consumer’s personal device.

Last but not the least, digital wallets are extremely easy to manage and use, and feature different ways you can conduct a payment. Some of the digital wallets even allow their clients to withdraw cash from ATMs.

On the other hand, there are also various benefits of digital wallet for service providers and financial institutions. For instance, digital wallets are much easier to implement and maintain, they cannot be stolen or lost like regular wallets. The data stored there is secure and encrypted, which may add to the credibility of a vendor.

Along with the debit and credit cards, some providers can also include add-on features to encourage more clients to use their services: cryptocurrency, insurance cards, boarding passes, concert tickets, coupons, and gift cards, virtual IDs, and driver licenses, and many more.

Finally, by investing in a secure digital wallet, you can implement it just about anywhere and use it for nearly any transaction, no matter online or in-store!

Main Challenges of Building & Maintaining a Digital Wallet App

Once you know why this technology is a great investment option, you’re more than likely to initiate the digital wallet development. However, before you get started, it’s essential to weigh all the pros and cons of this fintech trend.

Just like we’ve mentioned before, the core advantage of a high-quality, secure digital wallet is its convenience and ease of use. At the same time, there are plenty of pitfalls you might face during and after you create a digital wallet, that can significantly impact the product performance:

- Fraud and security. It’s essential to focus on constantly improving the mobile wallet security and eliminating the risks of hacking and security breaches, as they can hit not only the reputation of an organization but the significant financial losses as well.

- Awareness and adoption. Despite the high popularity of digital payment technologies, some people are still uncertain about their security, data privacy, and many more. For this reason, it’s essential to invest in the popularization of a current trend, as well as explain the basics of its usage and the benefits this payment method can bring to consumers.

- Merchant accepting. If the businesses are not ready to support the contactless payment methods, neither the clients will. That is why providing support on the mobile wallets adoption stages is essential to provide the customers with multiple payment options.

- Compliance with legal requirements and standards. For successful digital wallet development, it’s also important to ensure it is compliant with all the regulations. This not only enables performing the first-class services to its clients but also in the best interest of the companies themselves.

- Device compatibility. It’s not enough to simply create a digital wallet to make customers start using it – you should also maintain the app so it could be easily utilized across multiple devices on different operating systems.

- Wider functionality. The core idea of mobile wallets implies their usage for different purposes, including payment transactions, document carrying, and more. To stay at the top among competitors, it’s essential to adapt technologies that go beyond the standard payment approaches and enable a wider range of different functions included in the app.

Without any doubt, digital wallet development features plenty of different challenges to resolve. However, with all those factors considered and implemented, it’s more than possible to create a competitive, high-quality product that will surely compel consumers to switch to mobile wallets technology.

Best Practices of Launching a Digital Wallet Solution

Now that you know the major benefits and possible challenges of developing a mobile wallet technology, it's time to uncover how you can launch developing a safe digital wallet project.

1. Select the Type of Your Digital Wallet

Not all digital wallets are equal: their functionality and the area of use might slightly differ. So, one of the core steps on how to create a digital wallet is considering the most suitable type of app first:

- Open-loop or Closed-loop e-Wallets. These can either be used anywhere or only stick to a certain type of transactions we can perform. For instance, if the wallet is closed, like in Walmart or Starbucks app, you won’t be able to pay rent with any of these options.

- Mobile Banking Apps. Feature a robust set of functionalities and are used to deal with the financial services offered by a particular bank.

- Crypto Wallets. A completely new trend in the FinTech industry, that is traditionally used to buy, hold and transfer cryptocurrencies, and, because of its popularity, is now gradually migrating to mobile.

Once you’ve selected the most beneficial type for your product, it’s time to think over its main functions.

2. Consider Its Major Features

Implementing the core features is another important step in developing your secure digital wallet. It should cover all the top functions that enhance the wallet usability, ensure all the transactions are safe and cannot impact the security of customer data.

Additionally, such an app should feature a first-class customer experience to encourage people to switch to their digital wallets. Some of the main functions of a secure digital wallet include:

- Easy Registration, Sign-In, and Onboarding - Users usually try a lot of different apps and decide which of those they want to go on using in the first 3 to 7 days. By improving the UX and simplifying the access to a mobile wallet, you can significantly enhance its usability and reduce the bounce rate.

- Simple Payments - Another basic function that should always work smoothly. After all, that’s why people want to use it!

- Informative Transaction History - This feature always keeps your users up-to-date regarding the latest payments they did, so it becomes much easier to track the spendings. As a rule, it should display the time and type of transaction, as well as the name of a service provider that conducted it.

- Convenient Budgeting Trackers - Being usually presented as a standalone app, this feature can put your digital wallet onto the next level! Budgeting trackers can help to provide informative insights about the spendings across various categories and even give some great comments on its optimization.

- Valuable Rewards - This option adds more to the overall impression of the e-wallet, and performs as a compelling reason why people should start using it. For instance, a digital wallet can feature attractive cash back for certain categories or bonuses people can get by making payments.

These are only a few of the features you can add to make your mobile wallet app stand out from the competition. And, you can be sure that by offering the most beneficial UVP to your potential customers, maintaining the app functionality and performance, yet keeping them always engaged in e-wallet use, it’s more than possible to establish a first-class digital product!

3. Choose the Best Technologies

If you’ve ever wondered how to create a digital wallet or any other mobile app, then you must have already known that this process implies a thorough development process including various front-end and back-end techniques.

To ensure your mobile wallet flexibility and easier maintenance, it’s recommended to use native development tools: Swift (iOS) or Kotlin (Android). This way you can also make sure it will support the new features from the OS updates.

4. Make Your First Prototype

When getting started, it’s recommended to begin with making the interactive prototype of your digital wallet to save up on the time, resources, and costs needed to develop the app itself. You can first plan the screen designs based on the key characteristics of your target audience and which of their pains can be resolved with your app.

5. Develop & Test a Digital Wallet

Once the prototype is finalized, you can finally start the process of the digital wallet app development! To ensure your product will be secure yet bug-free, hiring a dedicated team of professional developers, like Intellectsoft, is a must-have for a successful project launch.

With over a decade of experience, our developers are always ready to deliver high-quality, feature-rich software products at the most reasonable price!

Conclusion

As you can see, building up a digital wallet is one of the most important innovations in the fintech industry that is only at its initial stages of development.

Once you’ve learned all the critical insights on how to create a digital wallet, yet uncovered the possible challenges and pitfalls to know before getting started, it’s the right time to start the development process!

Hiring a dedicated team of developers with solid experience and professional skills is one of the best solutions for creating digital wallets as well as many otherfinancial software development projects.